CoPilot

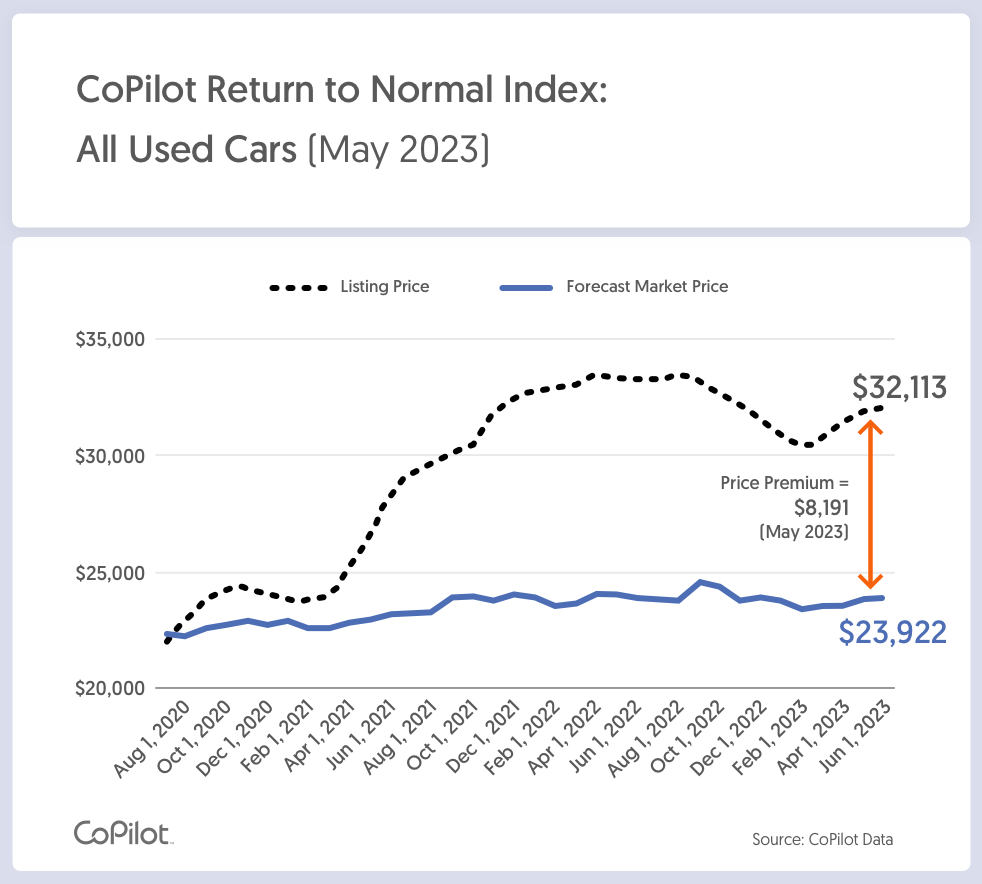

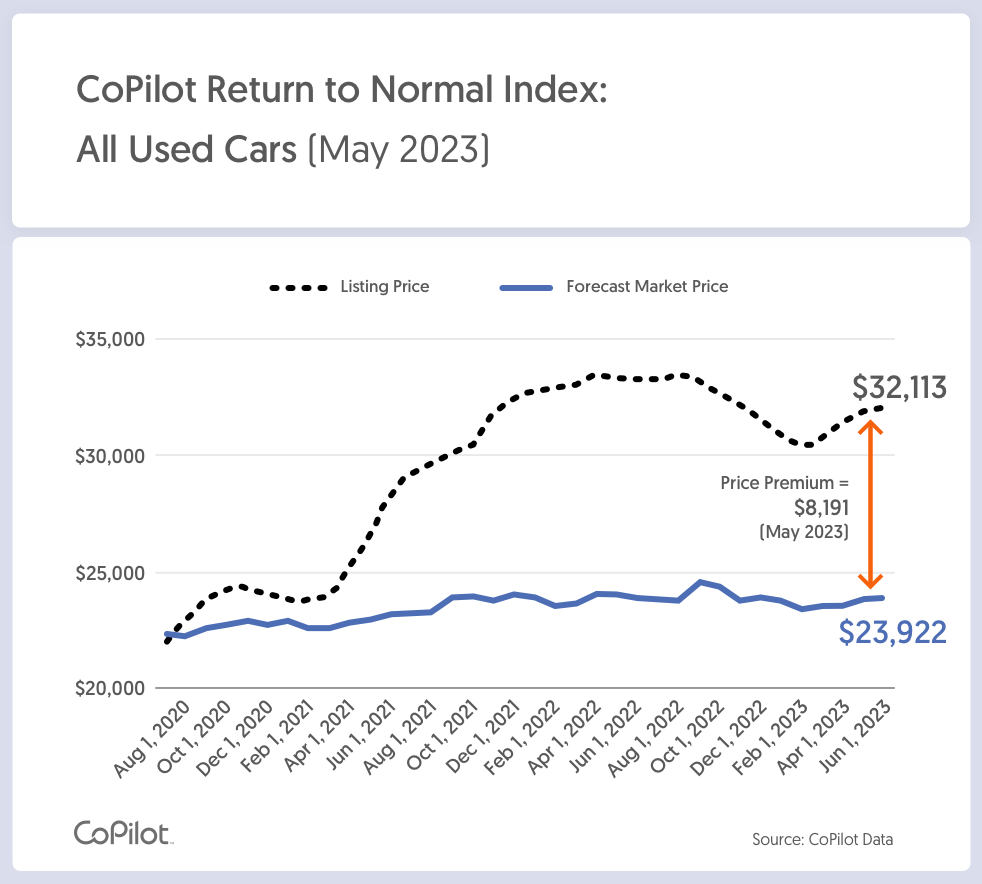

Forecasted used car prices and actual listed price show significant gap

As of June 1, 2023, used car prices increased for the fourth consecutive month in May, but at a slower rate than in April. Used cars were listed at an average price of $32,113 in May, up $194 (or 0.6%) since April. Amid strong consumer demand and confidence, particularly among more affluent consumers who continue to benefit from pent-up pandemic-era savings, used car prices have increased by $1,693 (or nearly 6%) since February.

CoPilot

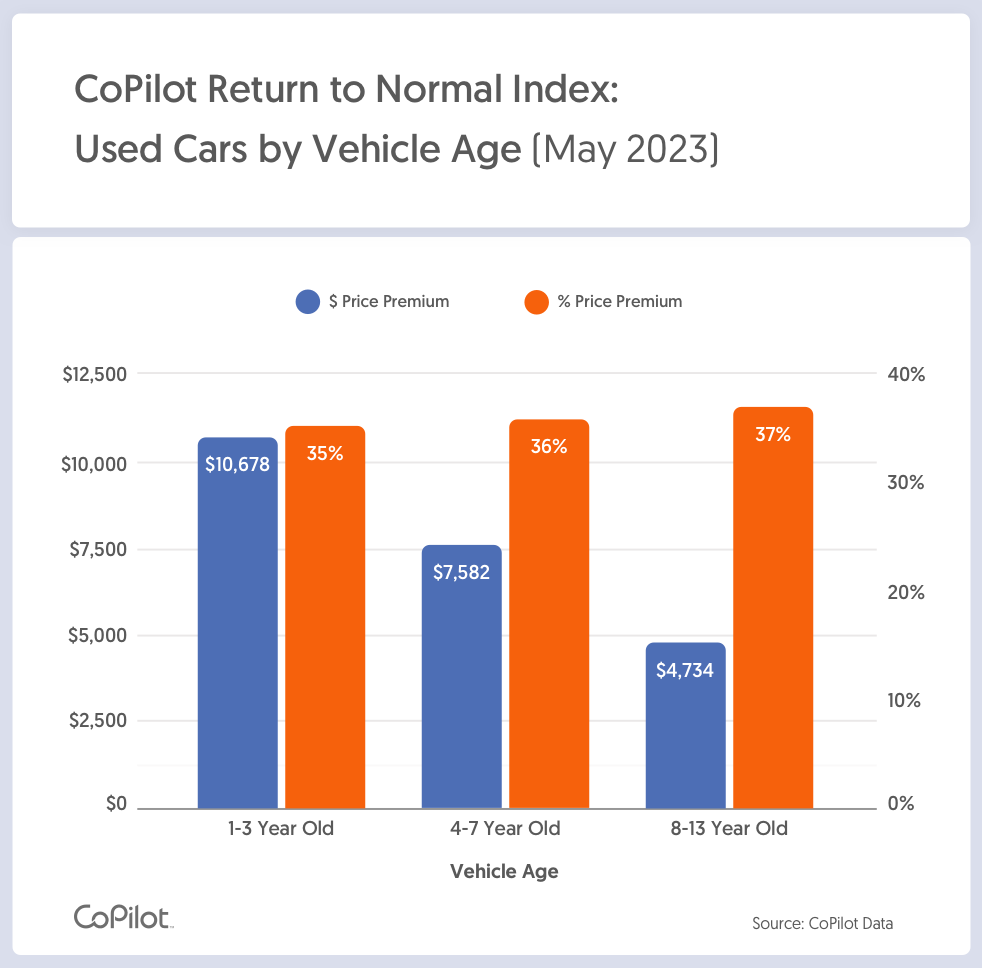

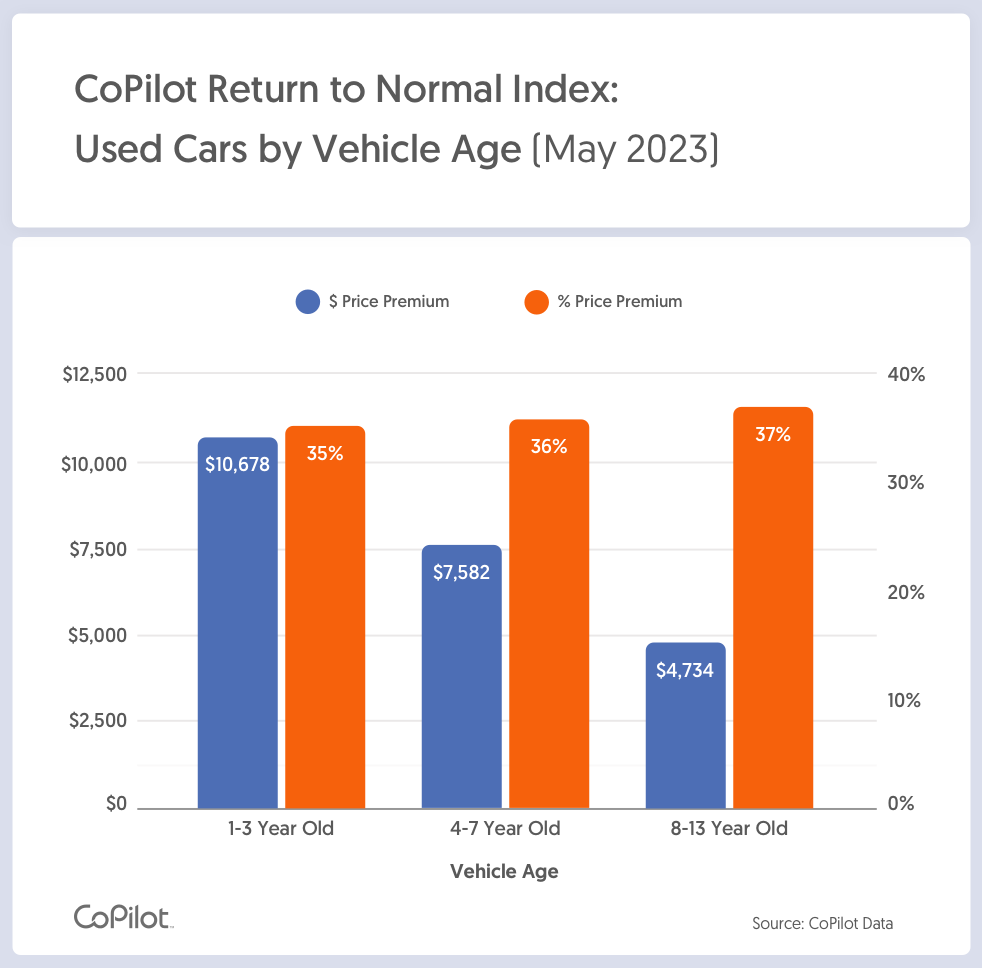

Price increases are highest for newer, more expensive cars

Prices of 1-3 year old vehicles dropped by a mere $225 in the past month to an average of $41,057, their sales jumped 9% in May, fueled by a strong Memorial Day weekend. With their average price hovering above $40,000 for the fourth consecutive month, these nearly-new vehicles are a strong indicator of robust consumer confidence and resilient demand, which will keep inventory low and prices elevated for the foreseeable future.

At the older, less expensive end of the market, tightening credit standards and higher interest rates are making vehicle purchases even less affordable in real terms. This part of the market is experiencing an inventory shortage, with dealers' supply of 4-7 year old and 8-13 year old cars reaching near-record lows, of 35 and 28 days, respectively. This is a trend that has been consistent throughout the pandemic: Since 2019, the proportion of used cars priced under $20,000 has fallen by half, from 53% of the used market to just 27% today.

CoPilot

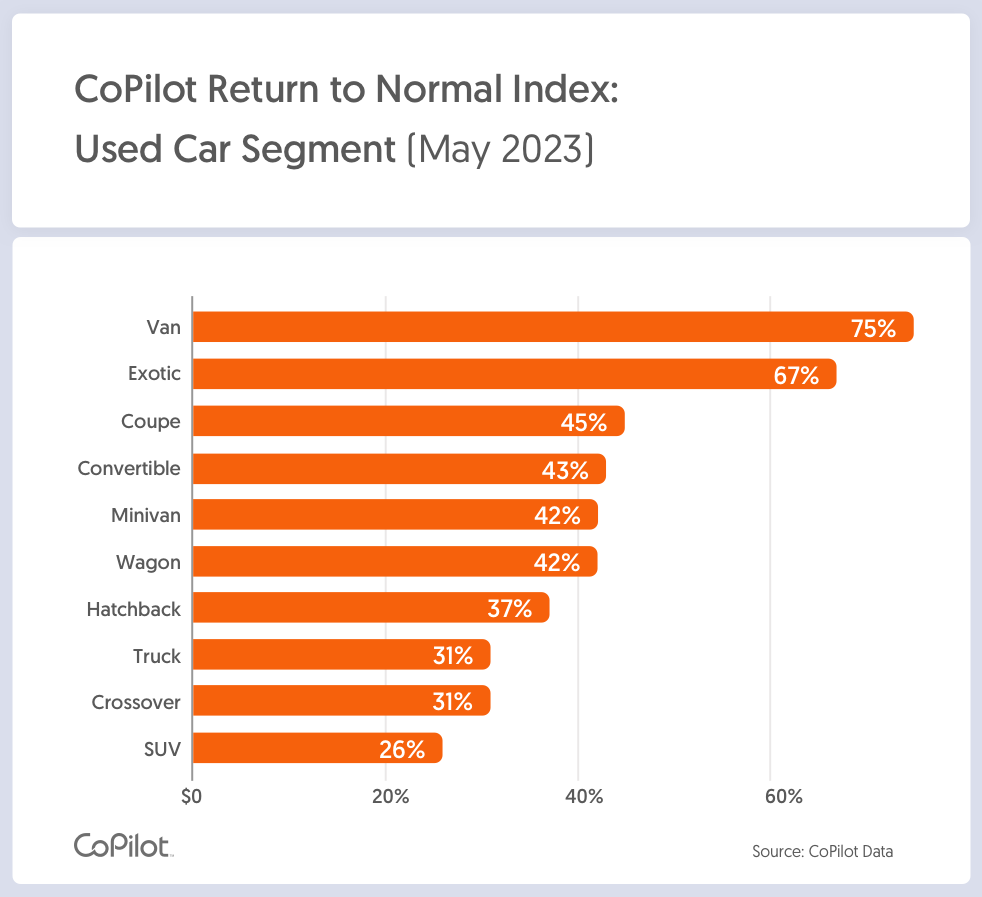

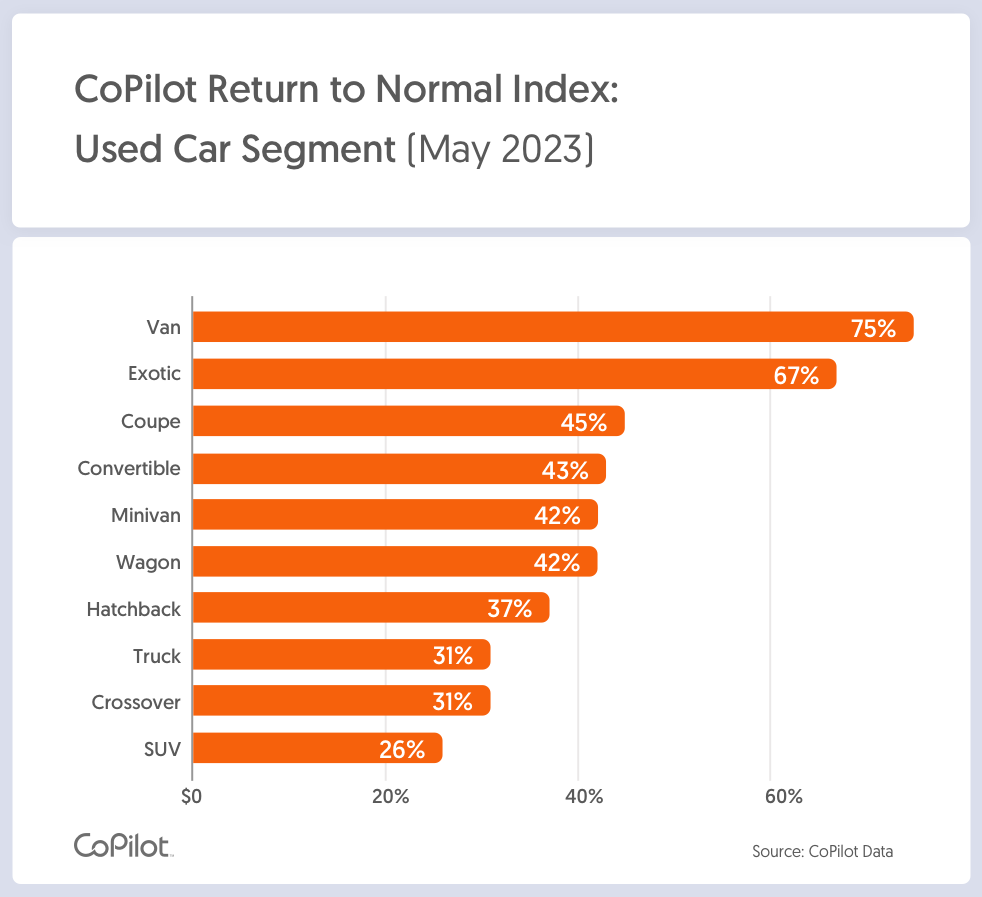

SUVs lead price surge, up a staggering 9% in three months

More expensive vehicle segments, particularly SUVs, lead the market's continued surge. Used SUVs – now on average $43,652 – have increased in price by $3,502 (or 9%) in the past three months alone. They are priced $9,076 (or 26%) above normal levels, a 53% increase in their Premium in that same time period.

Minivans increased in price for the second month in a row, now listed at an average price of $25,045. This represents a price increase of $541 (or 2%) since April. This marks the fourth consecutive monthly increase in Premium for used minivans since February. The average listing price for used pickup trucks was $41,529, up 0.7% (or $283) since April. This marks the third consecutive month in which used pickup truck prices increased. Despite this increase, used pickup trucks remain the segment second-closest to returning to normal levels, on a percentage basis.

CoPilot

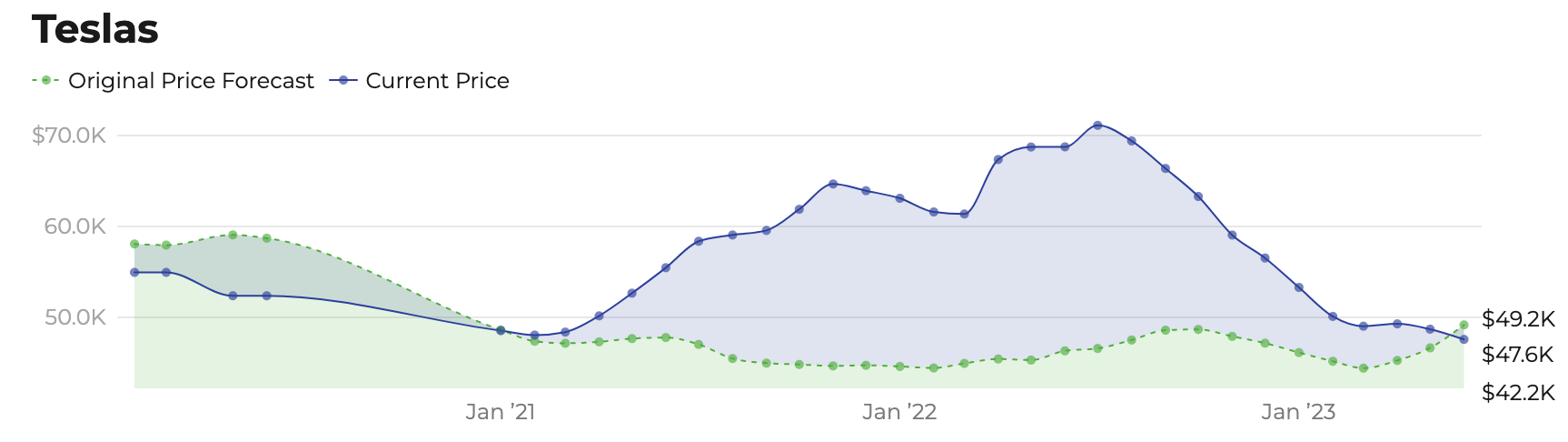

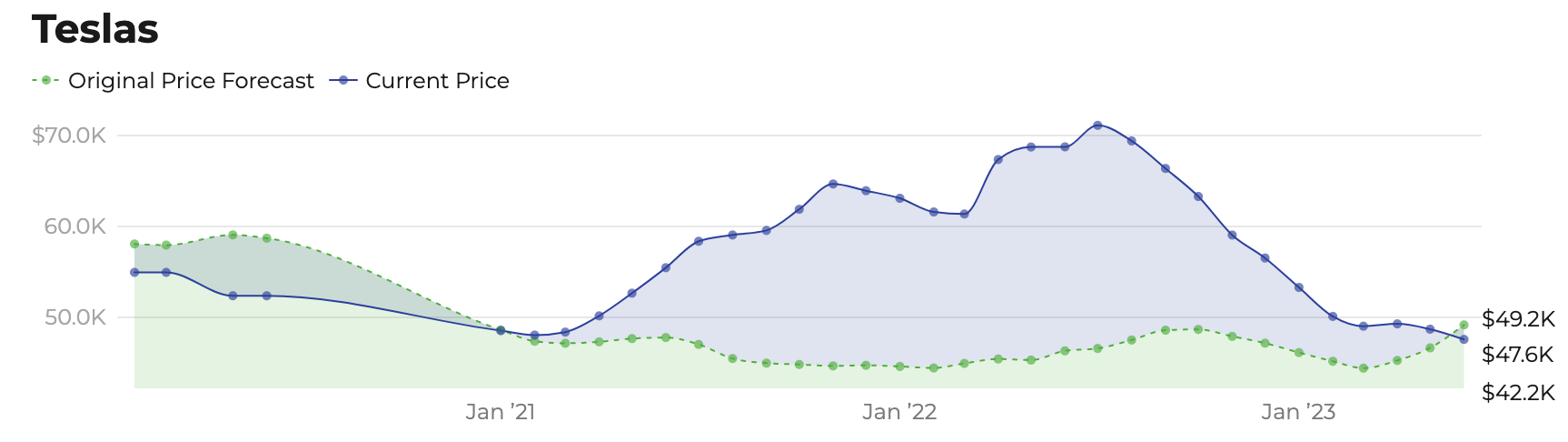

Tesla is the used car market's one bright spot

Since last summer, prices of Teslas and other electric vehicles have declined in tandem with gas prices, which peaked in July after a run-up in the spring of 2022. Used Tesla prices continue to plummet, dropping 33% (or $23,500) since last summer's peak, and down 8% (or $3,944) since the EV pioneer first announced price cuts to some of its new models in January 2023. In May, used Teslas, with an average price of $47,578, have become the first brand to reach normal price levels, now listed $1,598 (or 3%) below projected normal levels.

This story was produced by CoPilot and reviewed and distributed by Stacker Media.