Amid a leveling off of new and used vehicle costs, rising car insurance costs have caused a flat tire for drivers hoping for relief from the financial pressure of driving.

As part of a recent downward trend in inflation, gasoline prices were 25% lower in June 2023 than the same time last year, and consumers were finally beginning to get a little more bargaining power at dealer lots after years of slim pickings.

Recommended Videos

[RELATED: Here’s why car insurance companies are leaving some states, including Florida | Florida car insurance rates sit above national average]

The big surprise, however, was that auto insurance premiums started on a big uptick going into what was shaping up to be a less expensive summer driving season than last year.

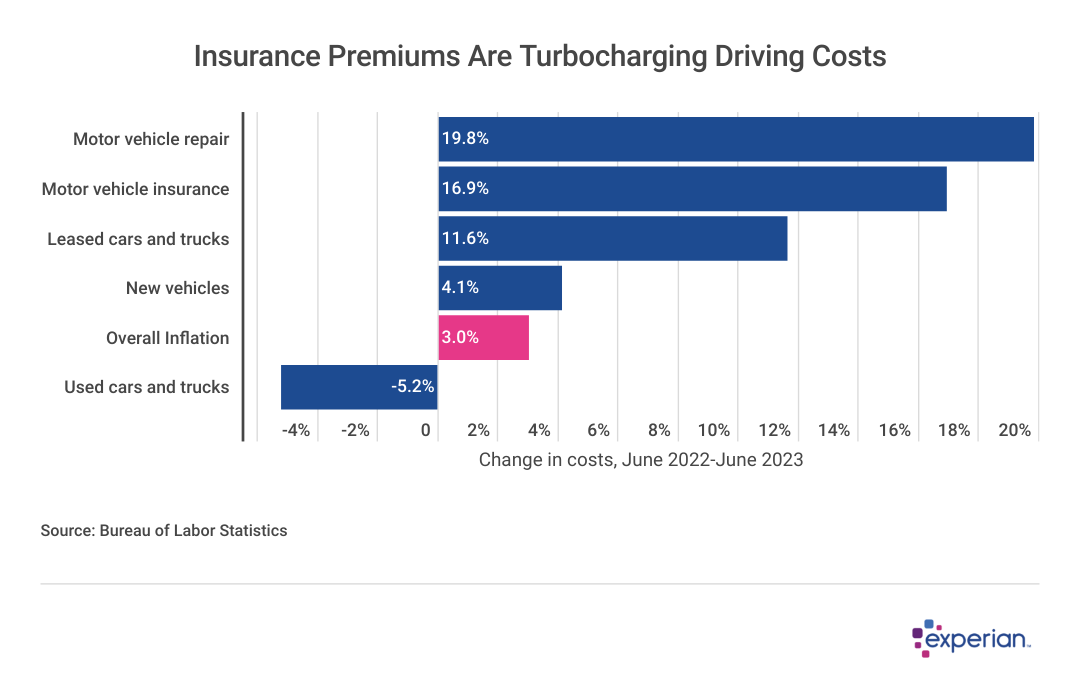

According to the latest look at consumer prices from the Bureau of Labor Statistics, insurance premiums have increased by 17% in the past 12 months, more than nearly any other component of the consumer price index as of mid-2023.

Experian breaks down what’s driving the increase, as well as what consumers may be able to do about defraying costs.

Experian

Higher-priced cars, higher-priced premiums

There's no getting around the increase in costs of all vehicles, both new and used, since 2020. And it stands to reason that an increase in automotive prices would be a contributing factor to rising costs for the attendant insurance coverage. However, the close to three-year lag time between the two increases makes the recent insurance cost hikes more conspicuous.

Of course, there's nothing one-size-fits-all about auto insurance costs, which means rising vehicle costs alone can't fully explain the rising cost of auto insurance. A range of factors can affect the cost of an individual driver's premium—in both directions.

For instance, insurers have noted that vehicular accidents are on the rise compared with previous years, with increases in both the number of claims and severity. In just the past year, the percentage of collision claims deemed a total loss by insurers increased from 24% to 27%, according to LexisNexis.

All the while, other costs for insurers—and drivers, by extension—are undeniably increasing:

- Repair costs: Parts and labor, both of which have been in shorter supply since the pandemic, are costs that are passed on to insurers who foot the bill after the claim and deductible are met by the consumer. In addition, new technology in cars is making them more expensive to repair. While a fancy car entertainment system might be able to be ignored when it's on the fritz, others, such as driver assistant technologies, often can't be.

- Replacement costs: When drivers are waiting for damaged cars to be repaired, some auto insurance policies provide for a replacement vehicle while the car is in the garage. Rental car prices—insurers are among car rentals companies' best customers—have increased for insurers as well as out-of-town travelers. And replacing the aforementioned total loss vehicles means getting the same queue for a new car as the rest of us, particularly if the replacement is for an electric vehicle.

Some auto insurance premium costs are largely out of your control

- Where you live: Presumably few people move for lower car insurance premiums, but all else being equal, there can be a vast difference in what you'll pay for your car insurance based on where you live. The disparities are obvious even at the state level, where premiums in high-cost states can be twice as much as those in inexpensive states. This is due to a number of factors, such as competition (or lack thereof) among insurers and regulations, which can vary greatly among the states. But like politics, all car insurance is local: You may pay more for your premium than you would the next ZIP code over.

- Your age (sort of): Your premium will be higher or lower depending on your driving experience, which, for most Americans, is largely a function of one's age. But as you become a more experienced driver, you may be able to lower your premiums once insurers consider you and your driving less of a risk.

Steps you can take to reduce car insurance costs

Despite the steep rise in insurance premiums, there are steps you can take to reduce how much you spend on auto insurance.

- Seek discounts. Car insurance discounts abound for many looking to reduce their premiums. Some of them may seem a bit of a chore, but are potentially worth the effort. Taking a few hours of your time to enroll in a defensive driving course can often lower your premiums by 15%. Also, many insurers now grant discounts to safer drivers who can prove it, by installing special equipment that tracks a driver's behavior on the road. More simply, just signing up for autopay could save you, as could having a multi-vehicle policy with one company.

- Choose your insurer carefully. Even bargain hunters may not find it fun to shop around for a new insurer, but the resulting savings might be spent in more exciting ways elsewhere.

- Bundle your insurance policies. Insurers, just like banks, are keen to get even more of your business once they have some of it. You can get started by asking your auto insurer if they offer bundling discounts if you add your rental or homeowners insurance to your policy.

- Improve your credit scores. Most states allow insurers to use credit-based insurance scores as a factor in determining premium costs. Taking time to improve your credit score can help in many areas of your financial life, possibly including reducing car insurance costs.

The bottom line

Auto insurance premiums cost consumers close to 3% of their annual income on average, so finding savings where you can on a product you'll hopefully never need can add up—something to consider before resigning yourself to a premium increase when it's time to renew your policy.

This story was produced by Experian and reviewed and distributed by Stacker Media.