Interest rates play a crucial role in shaping the true cost of a used car. The more expensive the car, and the higher the rate, the more expensive the monthly payment will be. But by how much?

There are a number of factors that influence your vehicle’s monthly payments, total purchase price, and overall ownership costs.

Recommended Videos

Black Men Sundays talks about building generational wealth. Check out every episode in the media player below:

Buckle up as we navigate used car financing, including the evolving landscape of used hybrid and electric vehicles. Understanding how interest rates impact affordability will help you make confident, informed decisions to get the best car, at the best price.

Using its PricePulse data set, CoPilot measures used car prices over time, highlighting trends in the market and the impact of interest rates on vehicle affordability.

CoPilot

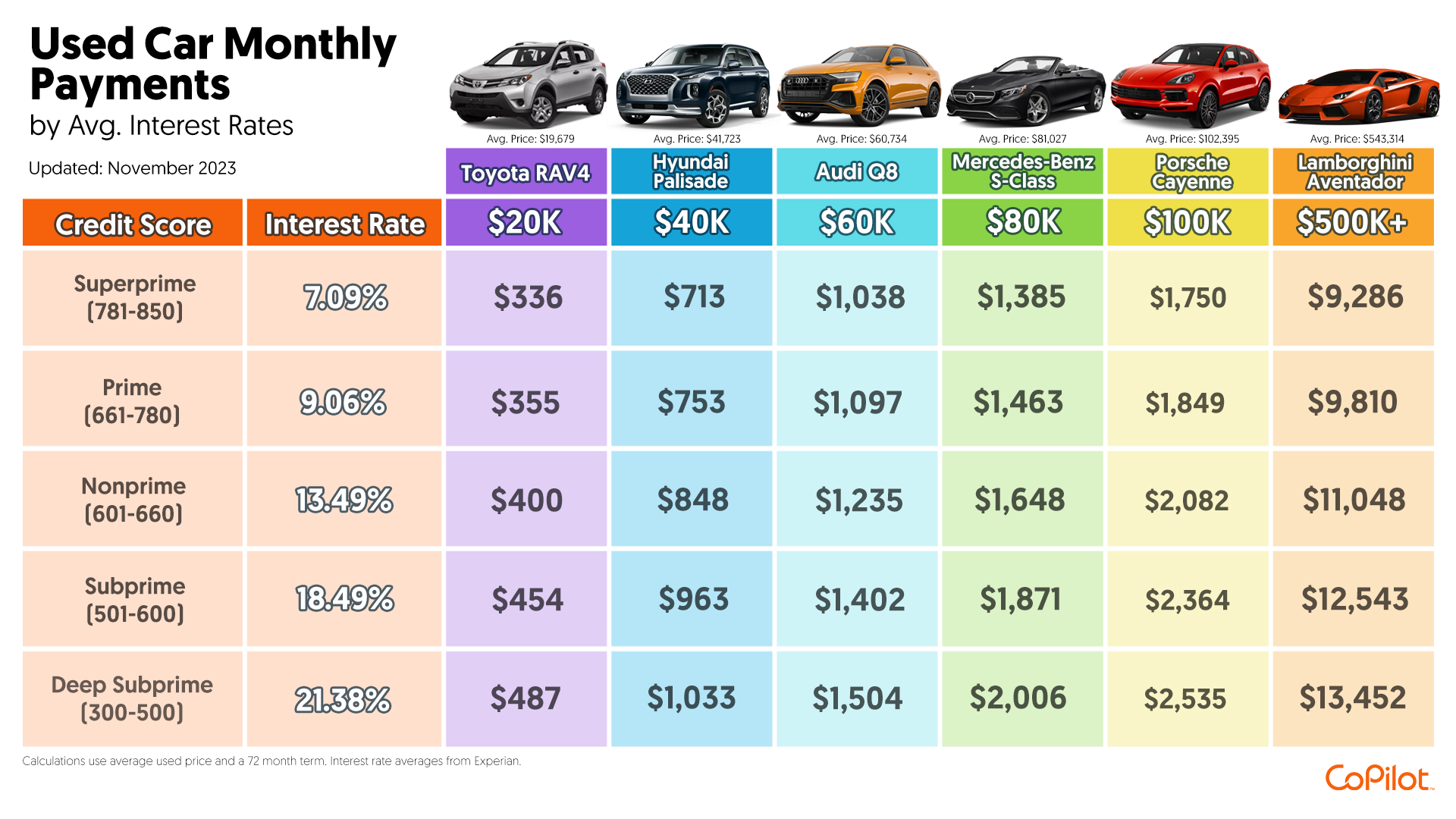

Your monthly payments

First, let's zoom in on the correlation between interest rates and monthly payments for gasoline-powered cars. This isn't just a numerical breakdown; it's a practical guide for understanding how credit scores impact your monthly financial commitment. For those with better credit (superprime), lower monthly payments are attainable, making higher-priced cars more accessible. Conversely, for those in the deep subprime category, affordability becomes more challenging, especially for pricier vehicles like the Porsche Cayenne.

Assess your credit score against the used car price buckets and their monthly payments to identify the most cost-effective path based on your financial standing. Consider opting for a more affordable vehicle or working on improving your credit score if the monthly payments are too high.

CoPilot

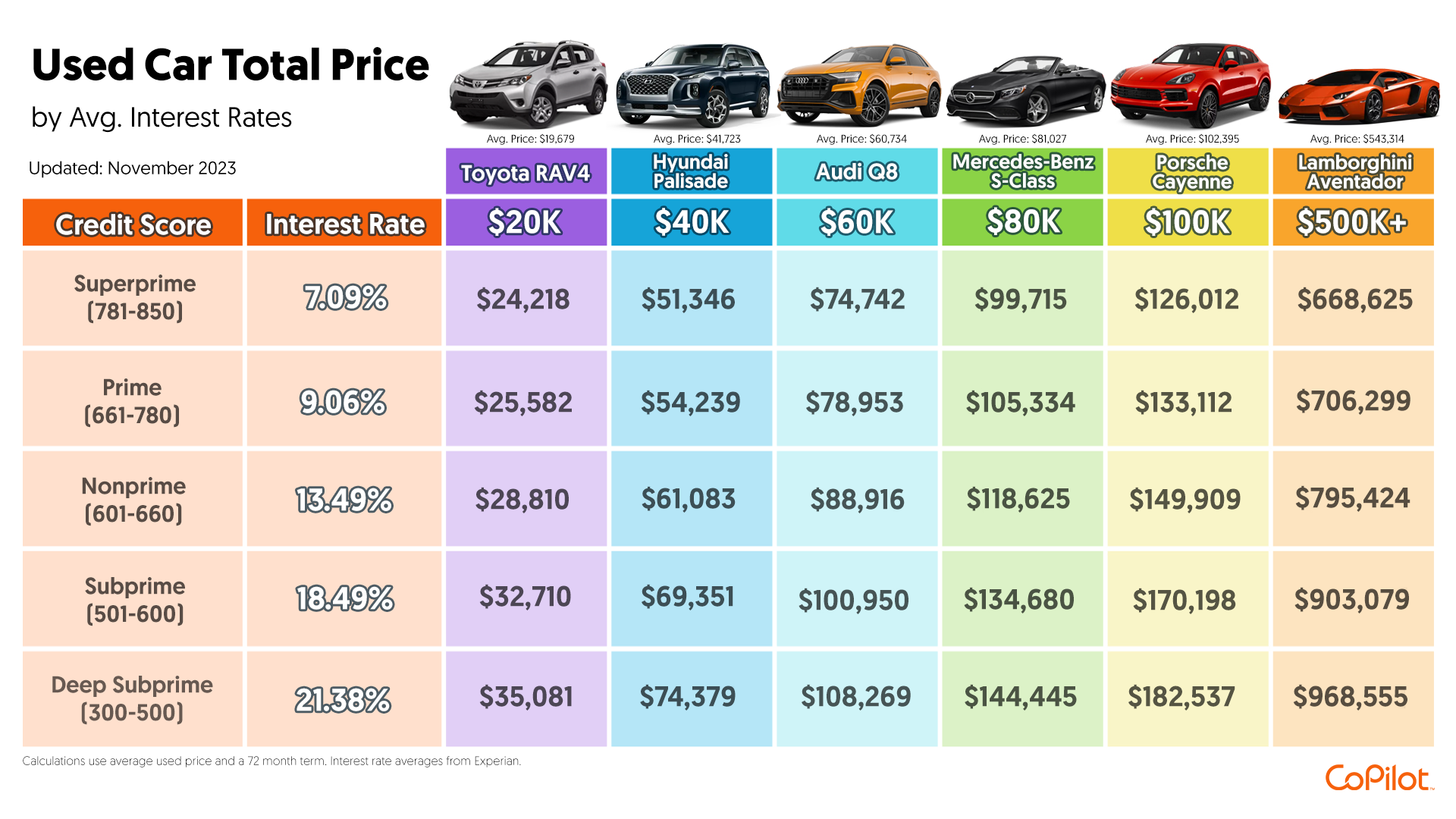

Total price paid

Not only do interest rates impact monthly payments, but they directly influence the total amount paid over the life of a loan. Carefully consider your interest rate, as even a small percentage difference can lead to a substantial difference in the final cost of the vehicle. Look at how much the total cost of a used Hyundai Palisade changes with just a slight increase in interest rate!

As you review the impact that interest rates and vehicle prices present across this table, the importance of credit scores becomes even more pronounced. But the road is not only defined by interest rates! Negotiation, dealer markdowns, and the current market dynamics all contribute to the total cost equation. Preparing ahead of time with market prices, vehicle comps, and pre-approved financing will all help to set you up for success in negotiation.

CoPilot

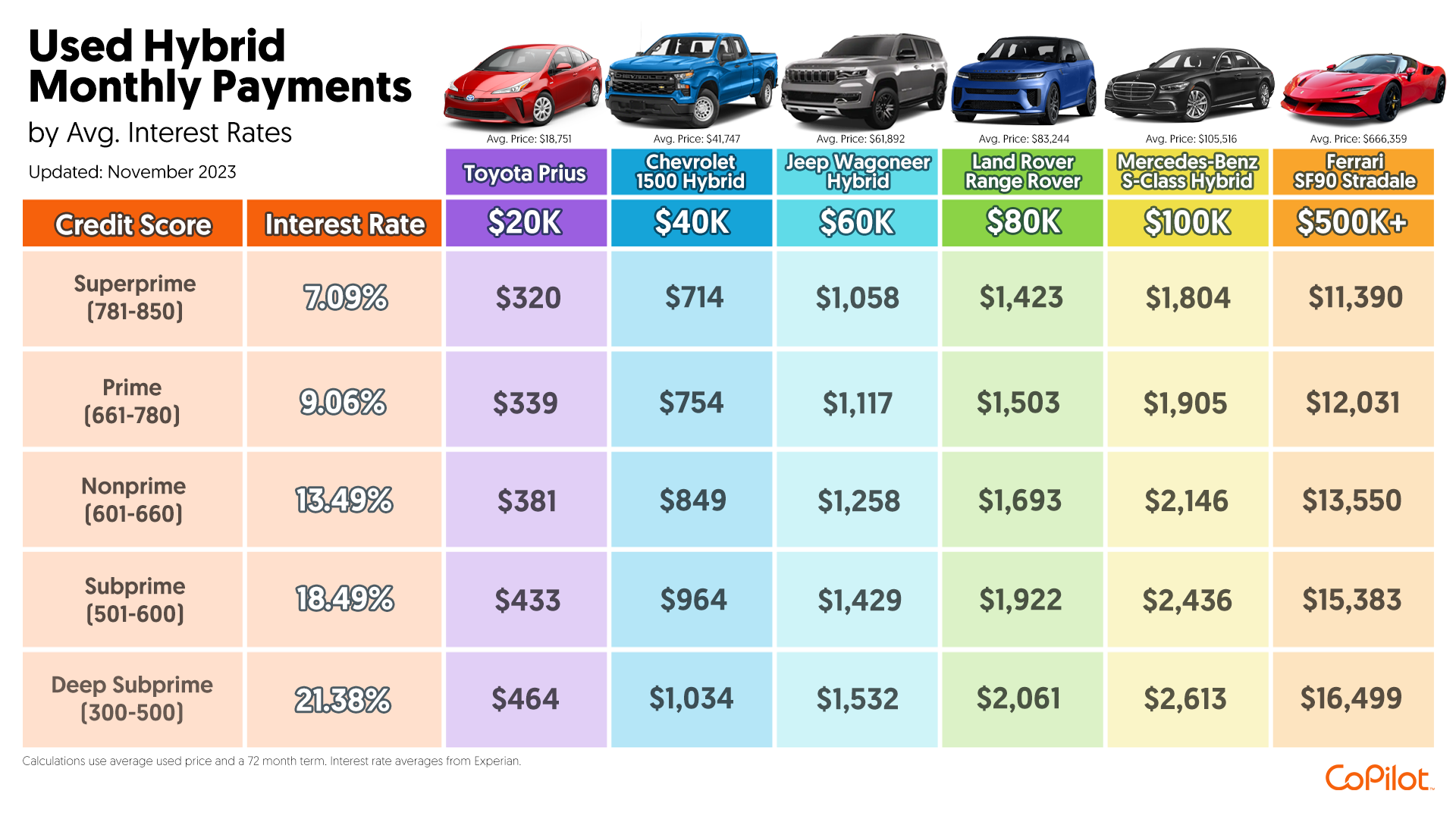

Hybrid vehicles

With the growing availability of hybrid models, you may be able to find more budget-friendly options in the used hybrid market. Despite a potentially higher initial cost, the increased fuel efficiency of hybrids can lead to long-term savings on gas expenses. Additionally, with an above-average market days supply for some hybrids, such as Mazda, buyers may find more room for negotiation, potentially leading to more favorable financing terms.

Price incentives for hybrids, aimed at promoting eco-friendly choices, can also offset initial costs. Whether a dealership mark-down or a government incentive, such discounts can significantly impact ownership costs, potentially making higher-priced hybrid vehicles more financially viable.

CoPilot

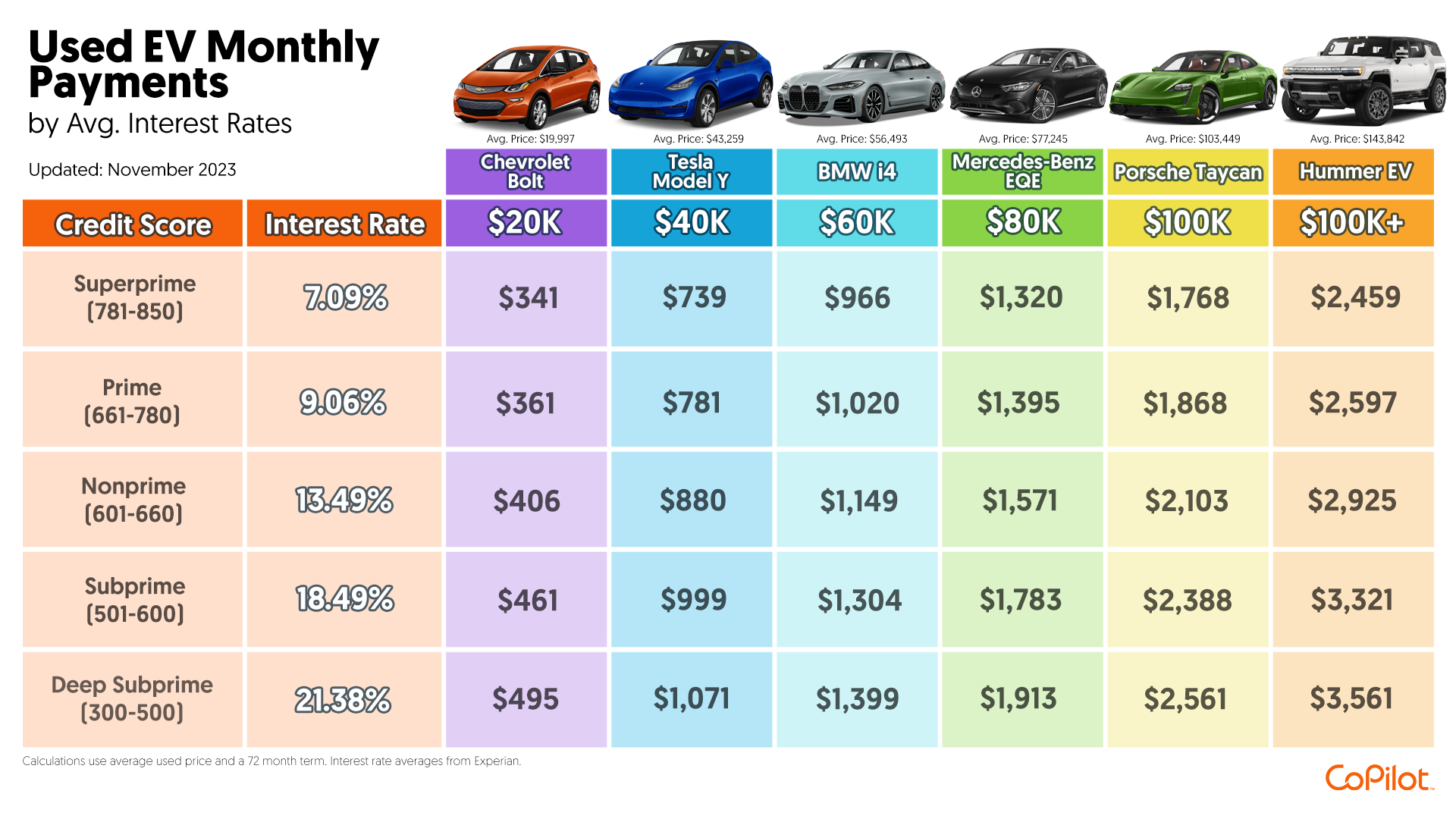

Electric vehicles

EV owners may benefit from a variety of incentives and tax credits, on top of some financial institutions and manufacturers providing more favorable financing terms for EV buyers, including lower interest rates! Understanding such incentives, lowered ownership costs, maintenance savings, and reduced fuel expenses, all enhance the overall financial appeal of EVs. Evaluate these long-term financial benefits, including available incentives, when considering electric vehicle ownership.

As we wrap up our exploration, remember that your journey is unique. Ensure your decision is not just financially efficient, but tailored to your specific preferences and priorities. Always be strategic in exploring incentives, negotiating effectively, and considering the long-term benefits of your chosen vehicle. Car affordability is influenced by a multitude of factors, and understanding them better empowers you to make informed decisions.

This story was produced by CoPilot and reviewed and distributed by Stacker Media.